In this post, we challenge two big concepts in DeFi;

These ideas distort user expectations, encourage mispricing of risk, and hold back the maturation of DeFi as an industry.

In this blog post we challenge these ideas, provide data to illustrate our points and hopefully pave the way for some constructive discussion on how DeFi vault metrics can improve from here in order to attract the next wave of institutional capital into the space.

Today, APY is the single most widely used metric when assessing DeFi vaults. We want to challenge this and hope to move the space away from APY as the sole-metric for making comparative assessments across vaults.

On the surface, APY feels like a clean, simple number - a quick way to understand what a vault should earn. But it’s not that simple. Most APY figures are snapshots taken at a single point in time. They take today’s rate and annualise it using fixed assumptions about token prices and borrow/lend rates. People naturally read that as a rough guide to what they’ll make over the next year without really understanding the assumptions within the APY methodology.

In reality prices move, farmed tokens can drop hard and borrowing/lending rates are volatile. In addition, APY calculations typically leave out the real costs (Total Expense Ratio) of running the strategy. Those add up fast in DeFi: impermanent loss, slippage, and transaction fees can be meaningful, especially depending on the market and the vault design. Many vaults exceed the capacity they were designed for which can create large slippage issues when liquidity tightens causing these costs to spike very quickly. In other words, what users actually earn can look very different from the headline APY.

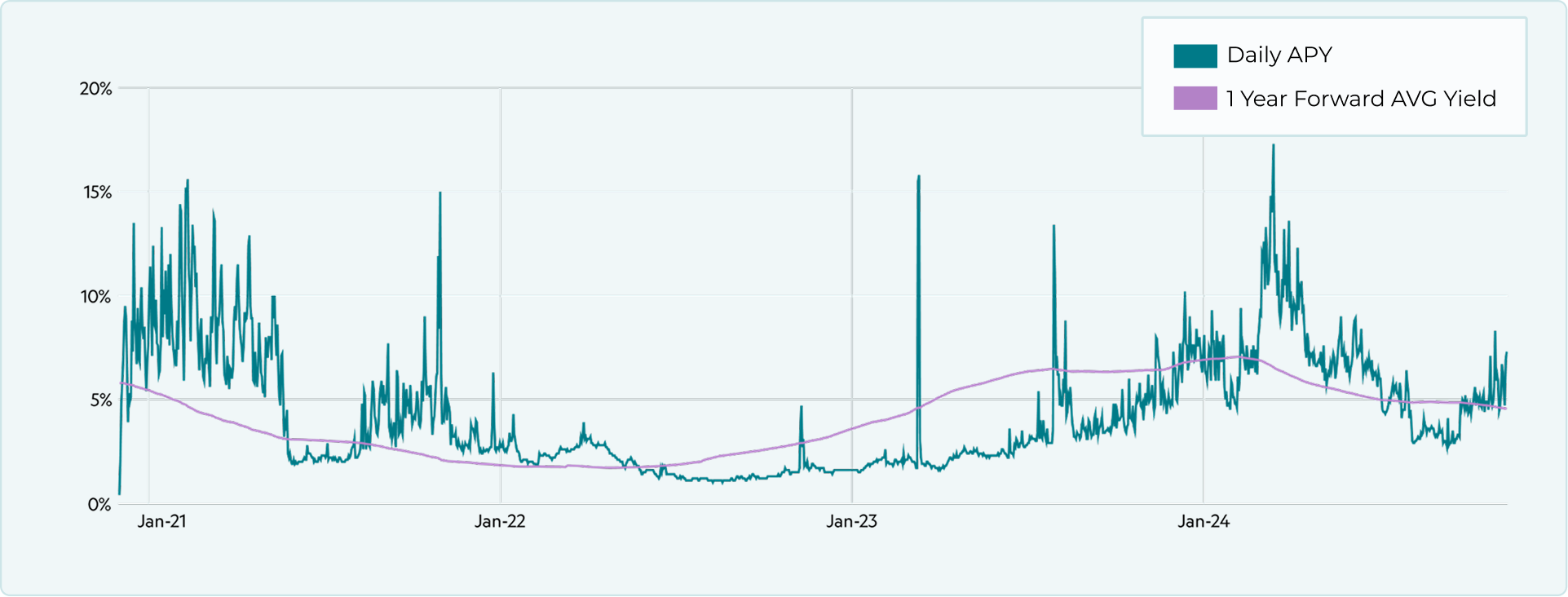

We’ve put some data together to help illustrate the point further. The turquoise line on the chart below shows Historical APY on three of the largest lending protocols (Compound, AAVE, Morpho) since 2020. The purple line shows you what you would have earned (1 year forward) on average if you had lent on those protocols at that point in time.

Historical APY vs 1 Yr Average yield

Immediately you can see that the variance is quite noticeable. If you had used APY to predict your future 1-year yield, you would have been off by a range of 0% to 13%.

Additionally, 1-year average realized forward yield outperformed APY about half the time and underperformed APY the other half the time - basically a coin toss.

This data hopefully reinforces the point that APY alone is not a good metric for predicting future yield.

The second idea we want to challenge is that vaults are liquid, just because it’s DeFi.

DeFi users intuitively assume that if something is on-chain, tokenised and non-custodial, it must be liquid. But this is not always the case.

Leveraged looping LST vaults

In recent months, the use of leverage looping in vault strategies to enhance the yield on LST’s has exploded which works fine when markets are liquid. However, it’s problematic when liquidity dries up as we’ve seen in the last few weeks.

For example, if one was to process a redemption in an 10x LST leveraged looping strategy in recent weeks, they could have experienced 40 basis points of slippage per loop on fairly small size. This adds up quickly when you have 10 loops (trades) to process to deleverage. The only other option to deleverage in tight markets is to natively un-stake. However, un-staking queues have also spiked in recent weeks to as high as to 45 days. Assuming 40 days to un-stake and 10x leverage - you’re looking at 40 * 10 = 400 days to process a redemption from this strategy in this market!

We doubt that many depositors understood these liquidity risks when entering LST looping products.

Morpho

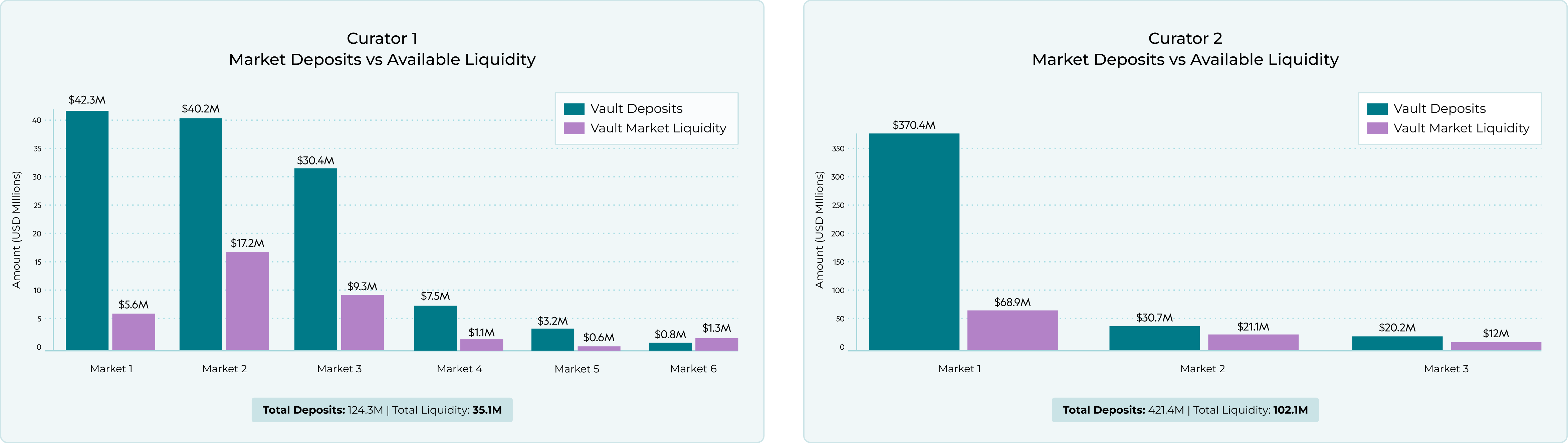

Let’s take a look at another example on Morpho. Below is a chart analysing two of the largest vaults on Morpho (taken Nov 28th, 2025) with curator/market names anonymized. The turquoise bars show the exposure each vault has to different markets and the purple bars show the available liquidity within these vaults. Both of these vaults are advertised as “low risk” which doesn't reconcile to the fact that more than 70% of each vault is illiquid.

We consider that depositors don't expect, and hence don't analyse, this liquidity profile. We argue that assessing the liquidity characteristics of vaults is another valuable metric against which vaults should be assessed in addition to APY.

Morpho vault exposure vs availability liquidity

A note on Stream / Elixir and side-pocketing in DeFi

This might be a good place to take a slight detour and talk about the importance of sidepocketing. In the traditional fund space, when you have a position that “blows up”, “defaults” or becomes illiquid, the standard practice dictates that you try to ringfence that position into what is known as a sidepocket. This is to ensure that all investors are treated equally. If some investors realise that there is a bad position, they may rush to redeem which can cause a “run” on the vault and leave the last depositor remaining in the vault , carrying the bad position in its entirety. By sidepocketing a bad position, you ensure that each investor wears the loss equally and nobody gets saddled with a disproportionate loss.

In DeFi, the concept of side-pocketing is nascent. In the case of some vaults that held positions in Stream/Elixir, we saw hundreds of millions being redeemed before the position was written down to zero and essentially ring-fenced. It is unclear why some vault managers waited so long to take action but the impact on some depositors was harsh. The last depositors remaining in the vault (who ironically were also the most loyal to the curator) took a disproportionate loss on these positions. Some depositors were disadvantaged due to poor management and tooling for these situations.

The bottom line is that liquidity is one of the most under-appreciated risk metrics in DeFi. It affects user experience, fairness and overall stability. Yet it is rarely disclosed transparently, almost never tracked in real-time, and there is a lack of tooling to handle tricky situations that require sidepocketing.

Given the above we are considering how metrics could evolve to ensure more meaningful comparative assessments of vaultHi Zoes working across the ecosystem to gather insights before considering how to operationalise

The beauty of being on-chain is that historical track records of auditable, verifiable NAV (net asset value) exist.

It’s therefore a huge waste to not use this on-chain performance attribute to assess and compare curator’s track records rather than solely considering headline “APY”.

In addition, looking at the net performance, ensures that the costs incurred by a vault manager are being captured. Calculating impermanent loss, slippage and trading fees for example.

Without net return, these fees can very quickly add up and reduce the headline “APY”.

As strategies have become more complex in nature (cross-chain, leverage, etc), it is much more difficult to make sense of actual exposures. Some vaults even engage in activity off-chain which compromises the transparency aspect. Unfortunately tooling hasn’t caught up with these complexities and therefore an accurate and easily readable overview of a manager’s exposures is missing. Providing solutions to this issue would be hugely helpful.

Having a metric that clearly illustrates the liquidity of a vault up-front (eg. the real amount that can be unwound at any one point in time without impacting the market) as well as the slippage costs incurred for an exit to take place could be very helpful in evolving how we think about risk in DeFi. Lastly, better tooling for sidepocketing is something the industry could really benefit from too in order to protect depositors and ensure they’re treated more equally when things go wrong.

In summary, APY alone is not a good metric of performance and ignores risk. DeFi has always prided itself on openness, data availability, and permissionless innovation. But we cannot continue to solely rely on simplistic metrics like APY as the ecosystem matures. . We’re confident that with smarter metrics and tooling DeFi will succeed in becoming more widely adopted.

At Avantgarde Finance, we’re committed to building in house risk reporting and tooling but we also want to support the ecosystem’s growth. Therefore, if you are working on DeFi risk or reporting tools, we’d love to chat. Or, if you’d like to learn more about our products & services, don’t hesitate to get in touch!

📩 info@avantgarde.finance

🌐 https://avantgarde.finance

𝕏 @avantgardefi